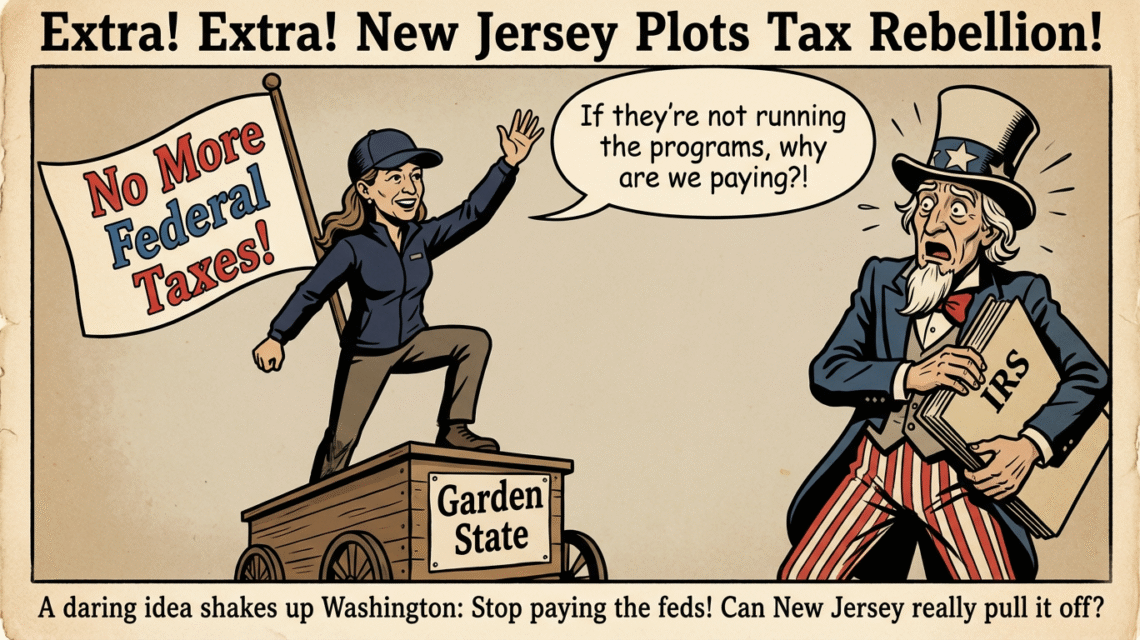

New Jersey’s Tax Revolt: Can Mikie Sherrill Really Stop Paying the Feds?

By Nkahoot Articles | November 22, 2025

Introduction: A Podcast Bombshell

Picture this: You’re listening to Jon Stewart’s podcast, sipping coffee, and suddenly Gov.-elect Mikie Sherrill casually says, “What if New Jersey just stops paying federal taxes?” That’s not a joke. That’s a real quote. And for a moment, everyone in the Garden State collectively thought, “Wait… can we do that?” Spoiler alert: Probably not. But let’s unpack this political curveball.

Why Is New Jersey Even Considering This?

New Jersey has a long-standing gripe with Washington: It sends way more money to the federal government than it gets back. According to the Rockefeller Institute, it’s like paying for a luxury cruise and ending up on a dinghy with no snacks. So Sherrill’s logic is simple: If the federal government isn’t delivering on programs, why keep paying?

“If they’re not gonna run the programs, then what are we paying them for? It’s like, you’re paying us for a service and they’re not delivering. So let’s stop paying for it.”

Sounds bold, right? But here’s the catch: Individuals and businesses pay taxes directly to the IRS—not through the state. So unless Sherrill plans to stand outside every Wawa and tackle people mailing checks, this idea is more symbolic than practical.

California Tried This First—And Reality Won

Before we crown Sherrill as the queen of tax rebellion, let’s remember Gavin Newsom. Back in June, California’s governor floated the same idea. And then reality showed up like an uninvited guest: “We’re assessing it… but it’s limited because most of that distribution comes from individual taxpayers.” Translation: You can’t just ghost the IRS. They’re not your ex. They’re the government. They have… prisons.

The Gateway Tunnel Drama: The Spark Behind the Fire

This tax talk didn’t come out of nowhere. During the federal government shutdown, Trump threatened to cut funding for the Gateway tunnel—a massive infrastructure project under the Hudson River. That’s a big deal for New Jersey commuters. So Sherrill’s comments are part frustration, part political theater. It’s like saying, “Fine, you wanna play games? We’ll play games.” Except the IRS doesn’t play games. They play Monopoly, and they own all the properties.

Could New Jersey Actually Do This?

- Federal Law: Taxes are collected by the IRS, not states.

- Legal Chaos: Any attempt to block federal tax payments would trigger lawsuits, penalties, and possibly federal intervention.

- Economic Fallout: Businesses and individuals would face massive fines. The state could lose federal funding for critical programs.

It’s like telling your landlord, “I’m not paying rent because you didn’t fix the sink.” Except your landlord owns the police, the fire department, and the roads.

Political Theater or Real Policy?

Let’s be honest: This is more about sending a message than writing a new tax code. Sherrill’s comments resonate with voters who feel shortchanged by Washington. It’s a way to say, “We’re tired of paying more and getting less.” And in politics, symbolism matters—even if the logistics are laughable.

What Happens Next?

Expect this idea to dominate headlines for a few weeks, then quietly fade away like most podcast soundbites. But it does raise important questions about federal-state relations and tax fairness. Should states that contribute more get more back? Or is this just the price of being part of the union?

Conclusion: Bold Talk, Tough Reality

Mikie Sherrill’s tax rebellion makes for great podcast content and fiery headlines. But in practice? It’s about as likely as New Jersey banning jug handles. Still, it’s a reminder that states are frustrated—and willing to float radical ideas to make a point.

The DMV Shutdown Diaries: October 3, 2025, A Satirical Breakdown of Bureaucratic Chaos

The DMV Shutdown Diaries: October 3, 2025, A Satirical Breakdown of Bureaucratic Chaos  Judge Rules Trump Administration Illegally Fired Workers — But Let’s Not Pretend That’s the Shocking Part

Judge Rules Trump Administration Illegally Fired Workers — But Let’s Not Pretend That’s the Shocking Part