Trump’s $6,000 Senior Tax Break: A Golden Years Giveaway or Just a Campaign Coupon?

Donald Trump’s latest tax proposal offers seniors a $6,000 deduction—but only if you’re old enough to remember when phones had cords and cholesterol was a personality trait. We break down the bill, the benefits, and the political math behind this shiny new tax carrot.

🧓 The Setup: Trump’s Tax Plan Gets a Senior Moment

In a move that’s part tax reform, part campaign strategy, Donald Trump has proposed a new tax deduction aimed squarely at seniors. The headline? If you’re 65 or older, you could get a $6,000 deduction starting in 2025. Married seniors? That’s $12,000—finally, a reason to stay married after 50 years of arguing about thermostat settings.

But before you start planning your retirement around a tax refund big enough to buy a used golf cart, let’s break down what’s actually happening.

📊 The Fine Print: Who Actually Benefits?

- Eligible: Seniors aged 65+ with taxable income

- Not Eligible: Anyone under 65, anyone with no taxable income, and anyone who thought “Big Beautiful Bill” was a new Netflix rom-com

- Duration: 2025–2028 (because nothing says “long-term planning” like a four-year window)

This deduction stacks on top of the existing senior standard deduction, which already gives older Americans a little extra wiggle room. But this new proposal is like adding whipped cream to a sundae you already paid for—sweet, but only if you’re already in the ice cream shop.

🗳️ The Political Math: Seniors = Votes

Why the sudden love for seniors? Because they vote. And they vote in numbers that make TikTok influencers jealous. Trump’s campaign knows that if you want to win Florida, Pennsylvania, and Arizona, you need to woo the 65+ crowd harder than a pharmaceutical ad during Wheel of Fortune.

This bill isn’t just a tax break—it’s a campaign strategy wrapped in nostalgia. It’s designed to make seniors feel seen, heard, and slightly richer—at least on paper.

💸 The Reality Check: $6,000 Sounds Sexy, But…

- If you’re a single senior with taxable income, you can deduct $6,000.

- If you’re married and both of you are seniors, you get $12,000.

- If you’re married and only one of you is a senior, you get confusion and possibly a passive-aggressive dinner conversation.

And remember: this is a deduction, not a credit. So it reduces your taxable income, not your tax bill. If you’re not paying taxes, this bill is basically a political promposal—flashy, performative, and ultimately meaningless unless you’re in the right demographic.

🧙♂️ Satirical Spin: If Tax Breaks Were Game Shows…

Imagine a game show called “Who Wants to Deduct $6,000?” hosted by Trump himself. Contestants must prove they’re over 65, married, and still filing taxes. The prize? A deduction that lasts four years and comes with a side of political theater.

Trump: “You’re 64? Sorry, folks, that’s fake senior. No deduction for you. Sad!”

Contestant: “But I have arthritis and a reverse mortgage!”

Trump: “Sounds like a personal problem. Next!”

🧾 What This Means for You (If You’re Not a Senior)

If you’re under 65, this bill is like watching your grandparents get a discount at the movies while you pay full price for popcorn. It’s a targeted giveaway, not a universal fix. And while it might help some seniors save a few thousand bucks, it won’t address deeper issues like:

- Rising healthcare costs

- Housing insecurity

- The fact that most retirement plans now involve working until you die

🧠 The Bigger Picture: Extending the 2017 Tax Cuts

This senior deduction is part of a larger push to extend the 2017 Tax Cuts and Jobs Act, which famously benefited corporations and high-income earners. So while Grandma gets a $6,000 deduction, Jeff Bezos gets a new yacht. Again.[1](https://www.factcheck.org/2024/12/trumps-agenda-taxes/)[2](https://www.factcheck.org/2025/03/both-sides-spin-who-would-benefit-from-extending-trump-tax-cuts/)

It’s a classic case of political optics: give a little to the masses, a lot to the elite, and hope nobody reads the fine print.

🧨 The Catch: Not Everyone’s Invited to the Party

- Seniors with little or no taxable income

- Younger Americans

- Anyone hoping for a refundable credit

- People who thought “Big Beautiful Bill” was a rom-com starring Ryan Reynolds

In short, it’s a selective giveaway, not a universal fix. And while it might help some seniors save a few thousand bucks, it won’t revolutionize retirement or fix the IRS.

🧭 Final Thoughts: A Tax Break Wrapped in Campaign Glitter

Trump’s $6,000 senior tax deduction is a clever piece of political packaging. It’s shiny, targeted, and just generous enough to make headlines. But like most campaign promises, it’s built on selective benefits and temporary relief.

So if you’re a senior with taxable income, congrats—you might save a few bucks. If you’re not? Well, you can always look forward to the next “big beautiful” bill. Maybe it’ll include a deduction for surviving election season without throwing your TV out the window.

📣 Call to Action

Want more satirical takes on politics, taxes, and the American dream? Subscribe to our newsletter and get weekly doses of comedy straight to your inbox. Because laughter is still tax-free.

Trump’s Project 2025: The Administrative State vs. The Reality Show Presidency

Trump’s Project 2025: The Administrative State vs. The Reality Show Presidency  “Trust Us,” said the Government, Right Before Gaslighting You Again

“Trust Us,” said the Government, Right Before Gaslighting You Again  The Founders’ Warnings and the Modern Two-Party System

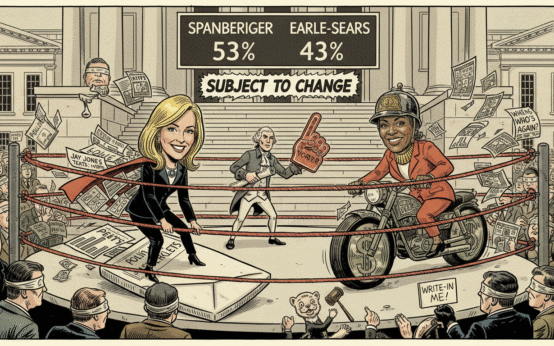

The Founders’ Warnings and the Modern Two-Party System  2025 Elections: Where Scandals Run for Office and Polls Are Just Fancy Coin Tosses

2025 Elections: Where Scandals Run for Office and Polls Are Just Fancy Coin Tosses  7 Best Satirical News Sites to Follow in 2025

7 Best Satirical News Sites to Follow in 2025